SUCCESS STORY

Blockchain & AI Enabled lending Platform (Artificial Intelligence, Blockchain, Application Services, Data & Analytics, Technology Consulting, Automation)

The Problem

The underlying objective of creating this application is to create a trust-less platform to facilitate the complete Lending process while ensuring complete transparency & fairness in dissemination of information to all stakeholders.

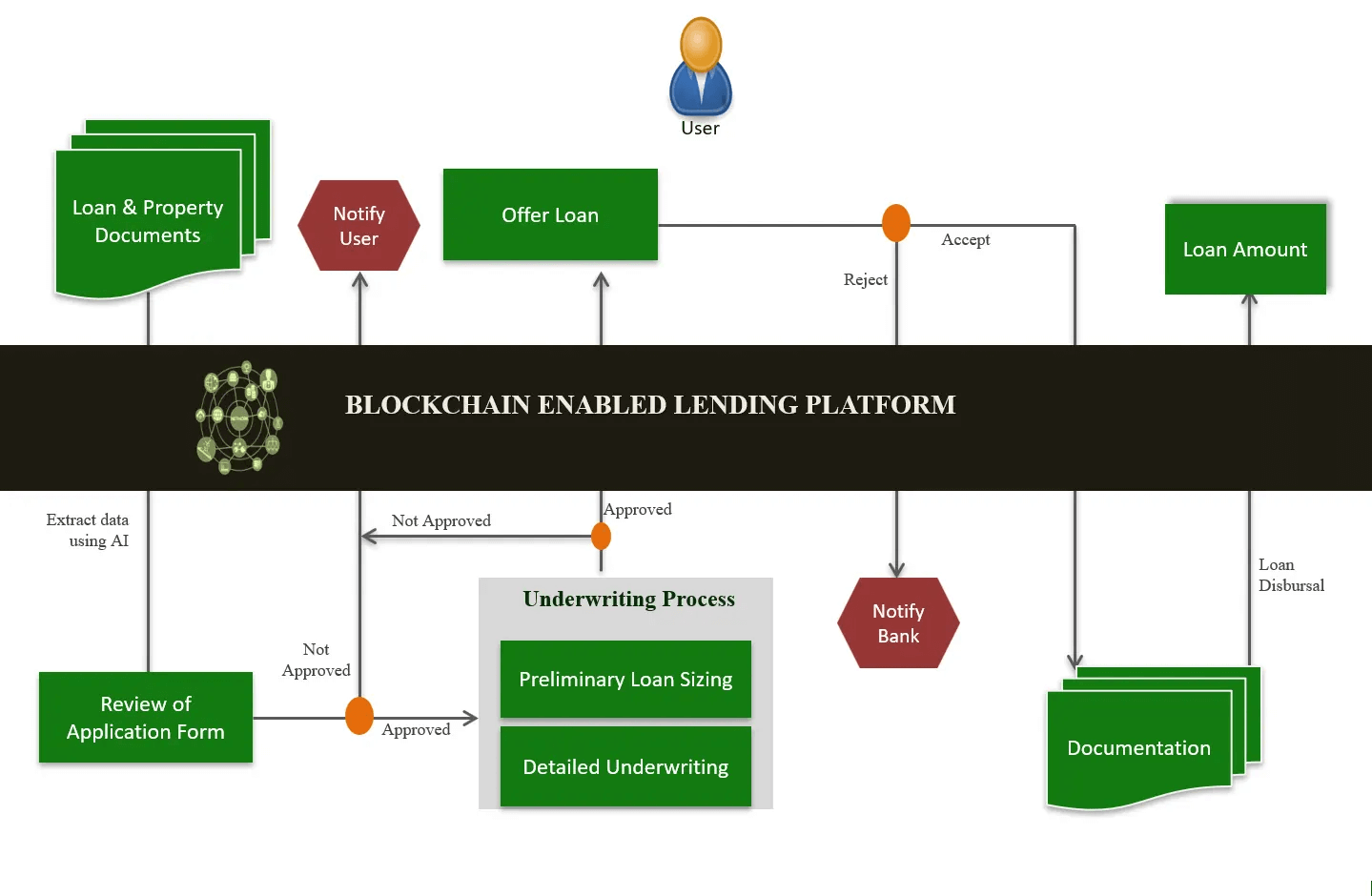

Process

- The entire process starts with a Borrower (or Broker on behalf of Borrower) by uploading the related property & borrower information/documents.

- Once uploaded, the loan application can be accessed by all the participating Lending agencies on the platform and the interested agencies proceed with due diligence/underwriting process.

- If the loan application meets all required criteria, these agencies then offer Loan to the borrowers with certain terms & conditions.

- The borrower then needs to choose the loan offer that best suits the borrower's purpose.

Advantages

Transparency

No scope of collusion between the platform and any of the stakeholders

Decentralized Application

By virtue of being a Blockchain enabled platform, this is a decentralized application where even if one node fails, the network would still be able to operate.

Independent Platform

The various participants do not have to trust or rely on any central authority to oversee the transactions.

Data Security

The technology ensures that all the recorded data is stored in an encrypted format thus ensuring top-notch data security.

Artificial Intelligence & IOT

Using AI based algorithms, Structured data can be extracted from borrower uploaded documents. Also, for IOT enabled properties, relevant data can be imported directly from the IOT servers.

Auditability

The platform allows for comprehensive auditability as it stores all the historical data securely owing to immutable property of Blockchain.

Token Generation

Custom utility Tokens will be generated to facilitate efficient transactions in the platform.

Accurate Status Tracking

Know the exact status of the loan application at any given time with a few clicks.

Underwriting Plugin

The platform provides the option of importing UW data from various sources including Lending agencies’ in-house web/desktop/excel based models.

BTM Financial Solution

- A new avenue to review loan applications easily by importing data from the lending agencies’ in-house Underwriting platform and make offers conveniently to worthy borrowers.

- A single comprehensive platform to apply for a loan and get loan quotations from different lending agencies in a completely transparent manner

Related Case Studies

Property and Loan Level Data Processing & Analytics (Automation, Application Services, Valuation and Advisory Services, Data & Analytics)

The underlying objective of creating this application is to process the unstructured data into structured format and performed the analytics on the cleansed data.

Read More

Data Warehouse and Dashboard/Tear Sheet (Automation, Application Services, Data & Analytics)

To create a distributed data warehouse and a dashboard/Tear Sheet in order to analyze various type real estate data. The client was looking for an integrated solution that could track the whole set of data in a single dashboard view with various filtered criteria.

Read More

Human Assisted Automation Suite (Artificial Intelligence, Data & Analytics, Automation, Business Process Outsourcing)

The Client’s has tons of data manually updated by its analysts. The client wanted to establish fast, human assisted automation suite for minimizing errors and time utilization.

Read More

Data Management & Reporting Tool (Technology Consulting, Data & Analytics, Automation, Application Services)

The client was looking for a solution that could read and analyze different sets (Images, video, geospatial etc.) of real estate data and to generate customized reports.

Read More

CMBS Credit Model (Application Services, Data & Analytics, Technology Consulting, Structured Finance, Fixed Income & Equity Analytics, Automation)

To design a database driven system to identify pieces of loans which exists in complex form e.g. A/B or Pari Passu structure. Also incorporate global assumptions which are NOI curve, Cap rate, Debt Yield threshold, largest tenant, LTV assumptions, Occupancy etc. for estimating Loss Severity, Timing and Amount of default, Balloon Loss Severity for each loan etc.

Read More

End to end mortgage analytics (Application Services, Data & Analytics, Technology Consulting, Structured Finance, Fixed Income & Equity Analytics, Automation)

Existing structuring solutions are third party tools that are license based on user and asset type making the cost structure very expensive.

Read More

Blockchain & AI Enabled lending Platform (Artificial Intelligence, Blockchain, Application Services, Data & Analytics, Technology Consulting, Automation)

The underlying objective of creating this application is to create a trust-less platform to facilitate the complete Lending process while ensuring complete transparency & fairness in dissemination of information to all stakeholders.

Read More

Data Mart Platform (Artificial Intelligence, Application Services, Data & Analytics, Technology Consulting, Automation)

The Data Mart Platform is built to aggregate Loan, mortgage & other data from various sources and store it in a structured format in a central repository. This data is made accessible to other tools & third-party applications in a secure & efficient manner via REST based APIs.

Read More

Regression Testing Suite Application (Quant Analytics, Application Services, Data & Analytics, Technology Consulting, Automation)

Regression Testing Suite Application (Quant Analytics, Application Services, Data & Analytics, Technology Consulting, Automation).

Read More

Term sheet model (Structured Finance, Application Services, Data & Analytics, Technology Consulting, Automation)

Build a comprehensive model to process complex inputs and generate the Term Sheet report.

Read More

Audit & validation reporting of CLO model(Structured Finance, Data & Analytics)

Finding the Inconsistency in the collateral and bonds cash flows in the model which was being compared with third party cash flows.

Read More

Pipeline management system (Cloud, Application Services, Business Process Outsourcing, Data & Analytics, Technology Consulting, Automation)

To develop a Pipeline Management System that contributes end-to-end development as well as integration of customized/Private APIs. API’s access /authentication is being provided in a very high secured environment.

Read MoreNeed a reliable technology partner?

Want to know more about the new art of problem solving?

4 Canterbury Road, Denville, NJ -07834, United States

Unit No. 807, Tower-B4, Spaze I Tech Park, Sector-49, Sohna Road, Gurgaon Haryana, India (122018)